ETH Price Prediction: 2025-2040 Outlook Amid Institutional Adoption and Technical Momentum

#ETH

- Technical indicators show ETH trading above key moving average with improving momentum signals

- Strong institutional demand and record futures open interest provide fundamental support

- Long-term growth potential balanced against quantum computing risks and regulatory evolution

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

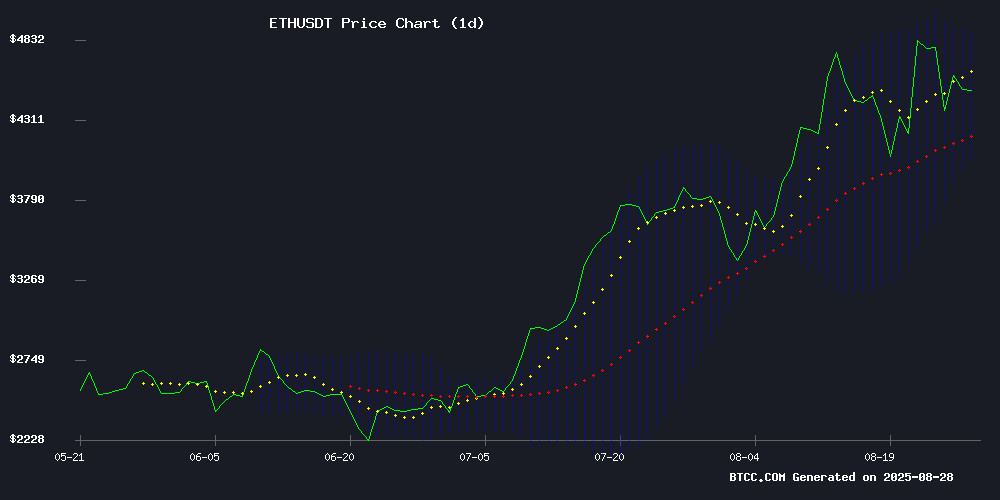

ETH is currently trading at $4,574.65, positioned above its 20-day moving average of $4,467.68, indicating near-term bullish momentum. The MACD reading of -92.84 versus -243.56 signal line shows improving momentum despite remaining in negative territory. Bollinger Bands suggest ETH is trading closer to the upper band at $4,885.54, with support at $4,049.83. According to BTCC financial analyst James, 'The technical setup suggests ETH could test resistance NEAR $4,900 if it maintains above the 20-day MA, though traders should watch for potential volatility given the current market conditions.'

Market Sentiment: Institutional Demand and Innovation Drive ETH Optimism

Current news flow surrounding ethereum reflects strong institutional interest and ongoing ecosystem development. Record Ethereum futures open interest, combined with Ark Invest's significant stake acquisition in BitMine and growing institutional adoption, creates a fundamentally positive backdrop. BTCC financial analyst James notes, 'The convergence of institutional investment, expanding ERC standard innovations, and real-world blockchain adoption in countries like the Philippines provides strong fundamental support for ETH's long-term value proposition. However, Vitalik Buterin's quantum computing warnings remind us that technological risks remain on the distant horizon.'

Factors Influencing ETH's Price

Jump Trading Alums Secure $20M for aPriori to Revolutionize On-Chain Trading

Former Jump Trading, Coinbase, and Citadel Securities engineers have raised $20 million in fresh funding for aPriori, a trading infrastructure startup focused on bringing high-frequency trading tools to blockchain networks. The round, which brings total funding to $30 million, saw participation from HashKey Capital, Pantera Capital, and other notable investors.

San Francisco-based aPriori is developing an execution layer for Ethereum Virtual Machine (EVM) networks, aiming to address persistent issues in crypto markets such as wide spreads and MEV leakage. The firm's system segments order flow in real time and redistributes MEV to stakers, potentially improving yields and network alignment.

The startup has already built a liquid-staking platform and Swapr, an AI-powered DEX aggregator, both designed to enhance execution for traders and liquidity providers. Pantera Capital increased its investment, citing aPriori's unique ability to bridge traditional execution standards with decentralized finance.

Investors Turn to OPTO Miner for Stable Returns Amid Ethereum's Volatility

Ethereum (ETH) has surged to record highs, drawing global investor interest. Yet, the accompanying price volatility has prompted many holders to seek more stable income streams. OPTO Miner has emerged as a popular alternative, offering daily returns of up to $3,000 through mining contracts.

The platform's 'contract-based profit' model eliminates the need for physical mining equipment or technical expertise. Users simply activate contracts and receive automated daily profit calculations, with principal returned upon maturity. This hands-off approach appeals to those prioritizing efficiency and transparency.

OPTO Miner supplements its core offering with user incentives, including $15 sign-up bonuses and referral rewards. The platform claims over seven million users worldwide, supported by 24/7 customer service and clean energy mining farms.

Ethereum Futures Hit Record Open Interest as Institutional Demand Surges

CME Group's Ethereum futures market has reached a historic milestone, with open interest surpassing $10 billion for the first time. The derivatives surge reflects accelerating institutional adoption, as evidenced by 101 large open interest holders—a record high—and over 500,000 active micro contracts.

Options linked to Ethereum futures breached $1 billion in open interest, while U.S. spot ETH ETFs absorbed $3.69 billion in monthly inflows. "The momentum shows stronger adoption from global funds," analysts noted, pointing to July's $7.85 billion open interest as precursor to this breakout.

Separately, BitMine's aggressive accumulation strategy aims to control 5% of Ethereum's circulating supply. The dual developments underscore ETH's maturation as an institutional asset class, with CME's standardized and micro contracts serving as critical infrastructure for professional traders.

Vitalik Buterin Warns Quantum Computers Could Break Crypto by 2040

Ethereum co-founder Vitalik Buterin has issued a stark warning about the looming threat of quantum computing to cryptographic security. By 2040, quantum machines could render today's encryption obsolete, with a 20% chance of this occurring before 2030. The implications extend far beyond cryptocurrencies, threatening the entire digital economy—from banking to smart contracts.

Ian Miers, a cryptography expert, emphasizes that the core concern isn't just retrospective decryption but the soundness of cryptographic systems. Blockchains and zero-knowledge proofs like STARKs may need to evolve to withstand quantum attacks. Market forces alone won't mitigate this risk, but post-quantum solutions like Ligero and Groth16 offer interim safeguards.

Ark Invest Amplifies BitMine Stake Amid Crypto Stock Decline

Cathie Wood's Ark Invest made a decisive $15.6 million move into BitMine Immersion Technologies across three ETFs—ARKK, ARKW, and ARKF—despite the stock's 7.85% drop to $46.03. The buying spree contrasts with BitMine's treasury swelling to $8.82 billion, including 1.71 million ETH ($7.9 billion), signaling institutional conviction in crypto infrastructure plays.

Concurrently, Ark trimmed $12.7 million in DraftKings exposure, reallocating toward Ethereum-centric strategies. BitMine's filing to expand its equity program to $24.5 billion—a 444% increase—for additional ETH acquisitions underscores the accelerating institutional embrace of crypto-native treasury management.

Philippines May Become First Country to Put Entire National Budget on Blockchain

Senator Bam Aquino's proposal to place the Philippines' national budget on blockchain could set a global precedent for fiscal transparency. The plan, unveiled at the Manila Tech Summit, aims to log every peso of government spending on an immutable ledger visible to all citizens.

The Department of Budget and Management has already deployed a blockchain solution on Polygon for publishing fiscal documents. BayaniChain, the local firm powering the platform, sees Aquino's vision as complementary to existing anti-corruption efforts—though blockchain alone isn't a panacea for accountability gaps.

While political hurdles remain, the initiative demonstrates growing institutional recognition of blockchain's potential beyond cryptocurrency. The Polygon-based implementation suggests ETH could benefit from increased public sector adoption in emerging markets.

ARK Invest Acquires $15.6M Stake in Ether Treasury Firm Bitmine

ARK Invest, the Cathie Wood-led investment firm, purchased $15.6 million worth of shares in Bitmine Immersion Technologies (BMNR), a prominent corporate holder of ether. The acquisition, spread across three ARK ETFs—Innovation (ARKK), Next Generation Internet (ARKW), and Fintech Innovation (ARKF)—totals 339,113 shares.

Bitmine, advised by Fundstrat's Tom Lee, holds over 1.7 million ETH tokens, valued at nearly $8 billion. The company's shares dipped 7.85% to $46.03 on the day of the purchase, aligning with ARK's strategy of buying during downturns to rebalance ETF weightings.

Ethereum's ERC Standards Drive Wallet Innovation with Privacy and Cross-Chain Capabilities

Ethereum's evolving technical standards are reshaping blockchain wallet infrastructure, with ERC-4337 leading the charge in account abstraction. This smart contract-based approach enables gasless transactions and social recovery features—key milestones in user experience.

The ecosystem's focus extends to regulated sectors through ERC-3643, embedding compliance directly into tokens for real estate and private funds. Two emerging standards—ERC-7930 and ERC-7828—address blockchain interoperability through machine-optimized address formats and human-readable layers respectively.

These developments signal Ethereum's maturation as a foundational layer for decentralized finance. The proposed EIP-7702 further bridges the gap between externally owned accounts and smart contract functionality, potentially unlocking new use cases.

Ethereum Dominates Wall Street, Says VanEck CEO

VanEck CEO Jan van Eck has declared Ethereum the preferred digital asset of Wall Street, citing its central role in the stablecoin ecosystem. Institutional demand is surging, with BlackRock's Ethereum fund attracting $262 million in fresh inflows, elevating its total assets under management to $17 billion. Meanwhile, VanEck's competing ETF lags far behind at just $3.35 million.

The Ethereum Virtual Machine's architecture continues to drive institutional adoption, with crypto whales accumulating ETH positions. Lookonchain data reveals concentrated buying activity among large holders, reinforcing Ethereum's status as the dominant altcoin in traditional finance.

Altcoins Surge as Market Trends Point to Growth

Cryptocurrency investors are closely monitoring altcoin performance amid shifting market dynamics. The TOTAL2 and TOTAL3 charts, key technical indicators, suggest a potential uptrend for alternative digital assets. Ethereum's supply scarcity and strong fundamentals create a favorable environment, while macroeconomic factors like Powell's recent statements add complexity to short-term predictions.

Analyst Noach highlights the recovery of critical levels on the TOTAL2 chart, signaling a mini-uptrend that could propel altcoins further. This technical outlook comes despite geopolitical uncertainties including potential Russian sanctions and tariff developments that typically introduce market volatility.

Ethereum and Remittix Gain Attention Amid Uniswap Scam Fallout

Ethereum and Remittix are drawing significant market interest following a $1 million scam on Uniswap, highlighting ongoing security concerns in decentralized exchanges. Ethereum, trading at $4,411.82 with a $532.62 billion market cap, remains a cornerstone of DeFi and NFTs despite a 4.15% dip. Uniswap's token, down 5.68% to $9.70, continues to dominate DEX volumes but faces scrutiny over vulnerabilities like phishing contracts and rug pulls.

The incident underscores the risks of permissionless systems, even as Ethereum's smart contract dominance persists. Meanwhile, projects like Remittix are gaining traction by emphasizing real-world utility and security—a shift investors increasingly prioritize. The market's response reflects a dual focus: caution toward exploitable platforms and optimism for innovative, secure alternatives.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, here's a projected outlook for ETH prices:

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | $4,200 - $6,500 | Institutional adoption, ETF developments, scaling solutions |

| 2030 | $8,000 - $15,000 | Mainstream DeFi adoption, regulatory clarity, ecosystem maturity |

| 2035 | $12,000 - $25,000 | Global blockchain integration, Web3 infrastructure dominance |

| 2040 | $18,000 - $40,000+ | Quantum computing adaptation, full ecosystem monetization |

BTCC financial analyst James emphasizes that these projections assume continued technological development and mainstream adoption, while acknowledging potential regulatory and technological challenges that could impact long-term valuation.